First published in Mint June 26, 2014

Hopefully, you may have heard of Thomas Piketty and his new book “Capital in the Twenty First Century”. He is the French Professor, who has been in the news in the past couple of months for launching his seminal book, which many feel might make him worthwhile to be considered for even the Nobel prize for Economics. In this piece, we show that Piketty’s Second Law of Capitalism applies to the Indian situation, and we try to interpret as to what does this mean for us. After reading this piece, hopefully, you may get some idea of at least a part of what is being discussed, and possibly, even develop a view on the same.

What is the Law and what does it mean ?

The Second Fundamental Law of Capitalism, as postulated by Piketty in the book, states that over long periods, “The ratio of the Wealth accumulated in a nation to the GDP of that nation tends to become equal to the ratio of the Savings Rate to the GDP growth rate (W/G = S/r)”. As per Piketty, this Law reflects an important point – As countries become wealthier and grow slowly over a larger base, returns from accumulated capital each year will become higher than savings from annual GDP. This may make the rich richer because they would be the ones having a larger share of existing wealth. Also, as the GDP growth rate slows down, opportunities for new entrepreneurs for becoming wealthy from scratch may reduce. As a consequence of these two phenomena, Inequality between the rich and the poor may increase. And that is a present cause for concern in the developed countries analysed in the book.

In the book, Piketty interchangeably uses the terms, Capital and Wealth. The discussion in this piece revolves around the Wealth held by individuals in India.

Current Indian Wealth

As of Mar 31 2013, Indian individuals possessed Rs 202 trillion (tn) of wealth (Source : Karvy India Wealth Report 2013). 1 trillion = 1 Lakh Crore. Of this wealth, Rs 110 tn is in financial assets and Rs 92 tn in gold and real estate. This Wealth is the summation of savings and investments of Individuals in India. This excludes holdings of Government, Corporates and Institutions. It includes promoter’s shareholdings in their companies. Real Estate excludes investments in primary residences, and only includes those in secondary residences – second, third and so on apartments.

Existing Wealth with Indian individuals is pre-dominantly invested to the extent of 36% in Debt (Fixed deposits, savings accounts, small savings, Insurance debt Investment), 13% in Equity (direct equities, equity MFs, ULIP investment), 30% in Gold (no introduction required) and 16% in Real Estate (as mentioned, this is only the amounts invested in second, third apartments, and that too, through non-cash routes). About Rs 11tn of the total 202 tn wealth is in cash in the hands of the public.

Wealth is getting added each year from two sources – The first is Savings from the GDP, which is the annual income of the country, and is being generated each year – GDP was about Rs 100tn in FY13. Since we have a savings-oriented culture, we save upto 30-35% of our GDP each year, and our GDP itself has been increasing at an average rate of 6-8% each year since 1991. Multiplication of these two factors is generating about Rs 15-20 tn of savings each year, getting deployed about 45% into financial assets and 55% into physical assets.

The second source of addition to wealth comes from the returns generated by investing the existing base of wealth. Each of these different classes of wealth appreciate each year by different rates, and together contribute as the second source to the Indian Wealth each year. The total contribution to Indian wealth from this source is currently about Rs 10-14tn each year.

Thus, currently, the annual contribution to growth in Wealth from annual Savings is higher than that from the annual returns of investing the cumulative base of the Wealth.

Forecasting Wealth, and testing Piketty’s Law

Now, we make appropriate assumptions and forecast Indian wealth, GDP, Savings rate, Inflation rate for the next fifty years, till the Year 2063. We also make assumptions on the returns coming from each asset class of wealth. We then test if Piketty’s Second Law applies to India, and also interestingly, try to see as to how will Indian Wealth, GDP look like in the future.

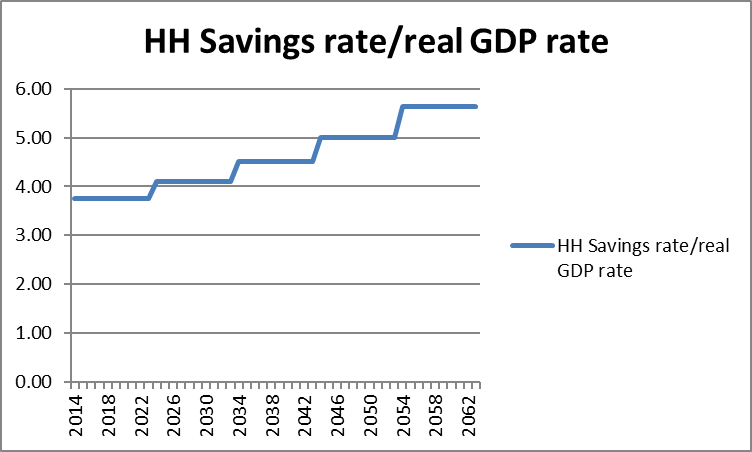

After growing the Wealth, GDP and Savings Rate for a 50-year period, we found that the ratio of the Household Savings Rate to real GDP growth rate starts from 3.75 currently and increases in steps to grow to about 5.5-6, fifty years from now.

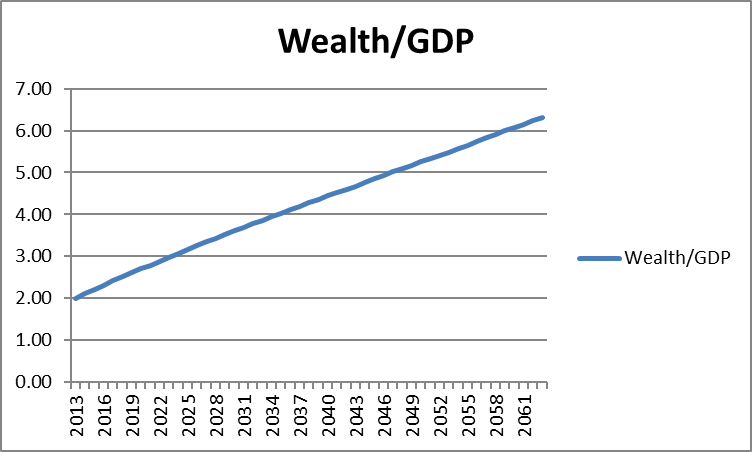

The ratio of Wealth to GDP today is about 2. This ratio increases linearly to increase from 2 to reach a level of 6-6.5, fifty years from now.

So…The Wealth/GDP and the Household Savings Rate/GDP growth rate indeed tend to merge in the 5.5-6.5 range !!!

So, what does this mean ?

First, let’s check on the learnings from the history of the West. This ratio of Wealth to GDP was in the 6-7 range for the countries of France, UK, Germany and the USA till 1910 but fell to the 1.5-3.5 range by 1950 as the Industrial revolution spread wealth across classes and the World Wars had an adverse impact on the larger businesses. In the post-War high-growth stage, this ratio has been increasing and of late has reached to about 6 for France, 5 for UK and 4 each for Germany and the USA.

Since ratio of wealth to GDP is only 2 for India currently, this means that India still has some way to go before serious wealth starts accumulating in a few hands. This has also been helped by a few factors in the past 2-3 decades – The Government owning most of oil & gas/infra companies, sustained reservation of backward classes, NREGA type subsidy initiatives and, our lop-sided “services-skewed” GDP growth.

However, interestingly, in India also, the annual contribution to Wealth from Investment returns will start outpacing that from annual Savings in the next 7-8 years itself. In a way, this means that we will become richer because of efforts of our past than what we have to do incrementally each year – this would be the test of having transformed into a developed country! Also, as mentioned earlier, Piketty concludes that this will increase inequality among classes and might lead to social unrest eventually!