Dec 28, 2016

It’s been 50 days since the PM spoke. This period could be divided into two phases – the initial phase of the first couple of weeks after the Demonetisation announcement (at the risk of sounding frivolous, called DeMo henceforth in this article). And the second phase till today. The absence of Cash since Nov 9th has impacted different sectors of the economy in different ways. I am not sure if anyone in the Government think-tank might have accurately predicted the magnitude of impact on the real economy and the different types of impact. This piece tries to look at Stock Market Index change for different sectors in the above two phases, and attempts to find the under-lying reasons for the trends.

There have been four different types of impact on different sectors :

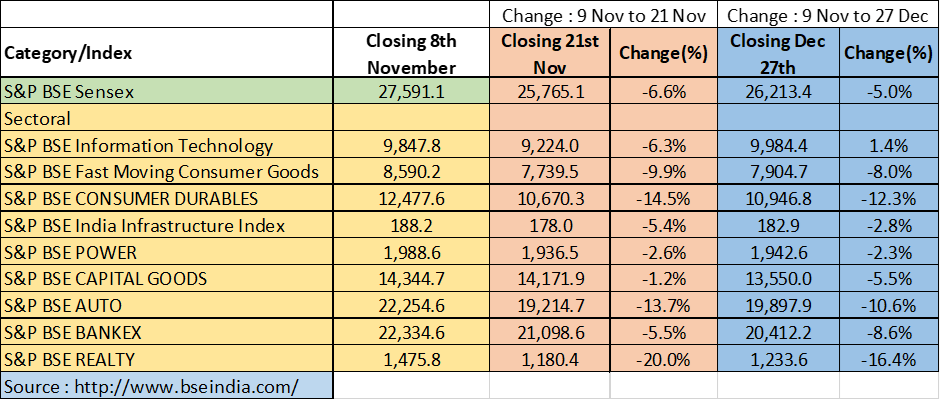

- Lack of cash to carry out transactions : This has been the single-largest factor hitting several sectors where the value of transactions was low enough for cash to be a very convenient medium for commerce. This has largely impacted the retail businesses – mobile recharges, retail outlets, FMCG sales, restaurants. The economists and analysts also got a crash course in reality of India when lack of cash also hit two-wheelers and Consumer Durables. If you were an ivy league Analyst sitting out of pincodes ending with 1 to 5, chances are that you might have missed out on this aspect of the Indian economy. Also revealing was the plunge in business of fancy restaurants to the tune of 20-50% in the 2-3 weeks after Nov 9th. It seems that significant proportion of people had been paying in cash even in such outlets, where average dinner bills for a family could be in the range of Rs 3000-10000. At this point, let’s see the below table. FMCG stock Index fell by 9.9% in first 12 days after DeMo and has recovered a bit to be at a 8% fall as of Dec 27. Consumer durables fell by 14.5%, recovering to 12.7% by Dec 27. Auto sector fell by 14% and recovered to an 11% fall by Dec 27.

- Operational hassles : Banks fell right in the middle of this chaos as they had to (and still are doing) exchange old notes, give new ones and handle crowds of 500-2000 per day per branch. Lending processes got hit as a result. Anyways, Borrowing businesses were too busy getting their cash position in shape to be bothered about applying for loans. Retail loans also slowed down as people started expecting a fall in rates and started the wait-and-watch game, a very dangerous game for retail Businesses. With significant deposits coming in in form of old notes and low take-off of new loans, banking spreads have continued to reduce in December and the BSE Bankex shows that by falling to 8.6% below Nov 9 levels, as compared to 5.5% below on Nov 21.

- Long-term Investment-oriented optimism : Part of the windfalls of the DeMo drive were supposed to be ploughed back into Infrastructure, Power sectors so as to effect the Development plank that the current Government had promised during elections. Hence, while Businesses in these sectors have not seen any change so far, their Stock Indices weathered any significant impact of the DeMo event. The Infrastructure Index fell by 5.4% immediately and then recovered to be 2.8% below pre-DeMo levels as on Dec 23rd.

- Perception led impact : The Real Estate sector – a regular whipping boy of Equity Market Analysts – may not have got impacted by lack of Cash so much as they got impacted by the perception that Real Estate prices are going to fall by 20-30%! The simplistic explanation proffered was that the sector was propped by 20-30% Cash and removal of that will reduce the artificially held high prices. The sector Index fell by 20% immediately. But as the reality is getting clearer, with apparently no strong rationale for prices to fall, the Index has recovered to be lower at 16% below pre-DeMo level, in double digit fall along with Consumer Durables and Auto sector. In fact, with RERA coming in, GST coming in and a slew of reforms having been announced, one would think that this sector will benefit from the clean-up and select stocks of Category A Developers may take off in the coming one year.

Thus, the impact of Demonetisation has to be found for each Sector by understanding the business drivers behind each Sector. Within the same sector, I am not seeing too many differential behaviours among companies. Many are still behaving like deer caught in the headlights, some like ostriches with their heads in the sand. Lying low and waiting for the storm to pass over seems to be the preferred Strategy!